Should I back or lay on the Betfair Exchange?

To back or to lay. It sounds simple doesn’t it. If you think something will happen you back it. If you don’t you lay it. In most cases it should be, but before you go and place your bets on the Betfair Exchange, try to answer this question. If you thought a game was going to have over 2.5 goals, would you back over 2.5 goals or lay under 2.5 goals? It is not a trick question, but there could be more value in one of those runners than the other.

In this article we’ll investigate the discrepancies and show how to work out which side of the book is more profitable.

Explaining the dilemma

Due to how odds work, there are certain gaps that can be exploited from the other side of the book. If you had a fair book and the overs had odds of 2, then you would expect the unders to also have odds of 2. This give both teams a 50% chance of winning. Backing the overs and laying the unders on the opposite runner would yield the same results if there were over the number of goals specified.

If the overs went above 2, does this change the dynamic? What about if the overs were below 2? Would we be better off laying the reverse outcome? Going in one direction the odds are changing by 0.01 each tick, the other way, they are changing by at least 0.02. This change matters. We’ll show some examples to show the impact of backing and laying for the same outcome.

Looking at real life examples on the Betfair Exchange

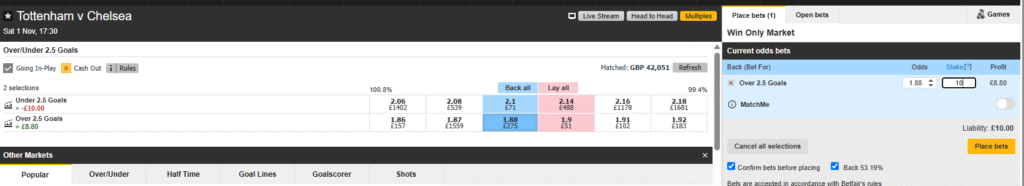

Overs odds are less than 2

Looking at the over 2.5 goals market in the Tottenham v Chelsea game, the current odds for over 2.5 goals are 1.88. If we place our £10 on this outcome, we make £8.80 profit. If it loses, we lose our £10 stake

That is standard. Everyone will understand that as it is the logical way to place a bet or trade if you think there are going to be over 2.5 goals. What would the result be though if you were to lay the under 2.5 goals runner. After all, the outcome is the same, it is just the route that is different.

This is where things start to get a little bit more complex. We still want to expose our £10 but as we are laying, we won’t be staking £10 in this instance. We need to find the staking value where, given the current odds, the liability comes to £10. Tools like Geeks Toy will do all the hard work for you and place the required stake. Doing this manually you need to use the calculation stake / (odds-1). In this example the calculation is £10/(2.14-1). We placed a bet of £8.77 which gave us the liability of £10

We can see that laying the unders in this example gives us 3p less return than backing the overs. It is not worth doing on this occasion.

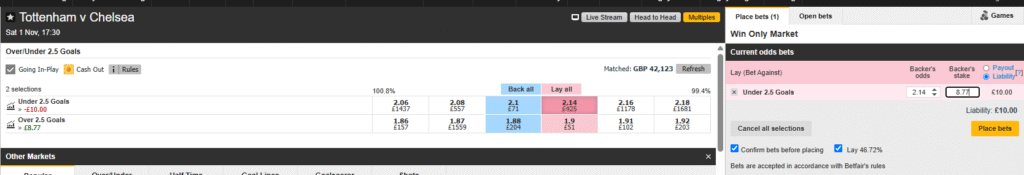

Overs odds are more than 2

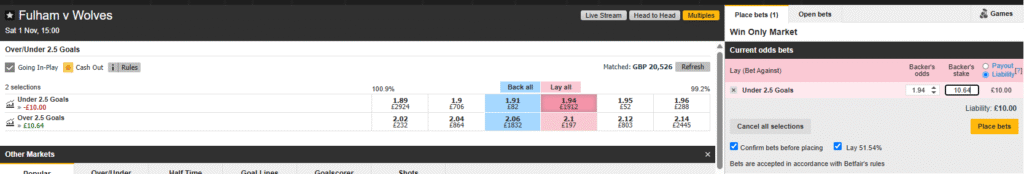

Let’s take a look at another example. Fulham v Wolves from the same weekend.

In this example the odds on over 2.5 goals is 2.06, meaning we’ll get £10.60 profit if this game was to see over 2.5 goals. The odds suggest there is less of a chance of over 2.5 goals than the previous example.

Reversing our logic once again, we can see that this time we have to use a lay stake of £10.64 to realise our liability of £10 (as the odds are less than 2). What we can see here is that we would make £10.64 by trading the game this way. This is a small improvement from backing the over 2.5 goals market but it would add up over time. If your stake was higher, this gap would also get wider.

So should we back or lay?

What we have just proved is that if the overs odds are under 2, it is better to back the overs, If the odds are over 2 for the overs runner, it is more profitable to lay the unders. This is assuming there are no significant gaps in the odds. The reason for this is that when the odds are under 2, the tick side moves in steps of 0.01. Anything over 2 moves at intervals of at least 0.02 so the percentage difference is a lot bigger on each change. We’ll demonstrate this with one further example using our Market Data Viewer.

We’ll pick the Bayern Munich v Leipzig game from August 2025. At the start of the game, the overs odds were 1.30 and the unders odds were 4.5. Let’s assume we’ll use our same £10 stakes.

Using the traditional backing of the overs method, we can see we would have a £3 profit for our £10 stake. As before, we would be looking at a £10 loss if there were under 2.5 goals.

If we chose to lay the unders at odds of 4.5, we would have only needed a stake of £2.86 to realise our £10 liability. We can see that this would be our profit if if trading the game this way (the Market Data Viewer sees the 1000 odds as cashing out at that point, hence the penny difference). This is approximately a 5% deficit from using the backing the overs method. If the odds were reversed and the unders odds were extremely short, it would give us a better return to use the lay method.

In conclusion

We can see from both methods, our liability remains the same but the levels of profit can vary significantly. This method works for any market where there are two possible outcomes. If the outcome you are in favour of is odds on (under 2.0) then you should be backing the outcome. If it is odds against (over 2.0) then you should be laying the reverse market. This will increase your profit, although very slightly, the difference will add up over time.

Great blog post.

A good article showing the difference between backing and laying on a market.

There certainly can be an advantage if you intend using the currently available prices.

If there are gaps on either side of the market you will never get the best value by rigidly sticking to one type of bet.

There is however a trick that you can use to make sure you get the best available profit which ever side of the market you prefer using.

Say for example you prefer to place back bets look for the highest price being asked for and submit your bet one tick lower than this. If the equivalent lay on the other side of the market is available you will be instantly matched. Amend your bet one tick at a time downwards until it is one tick higher than what is on offer. If the equivalent odds appear on the other side of the market Betfair automatically matches the bet. It is just how Betfair works…they want the maximum number of bets matched in every market.

it is quite hard to explain so hopefully I have done a reasonable job.

Is there any chance you can give an example please

What examples would you like? The screenshots are examples of two different markets, explaining how they behave.